LendingTree Ranks the Best and Worst Cities for New Small Businesses

Brittney Laryea

February 27th, 2018

When you’re just starting out as a small business owner, you want to be in the best possible position for success. While success is ultimately determined by a combination of factors, there’s no denying that some U.S. cities tend to produce more successful start-ups than others.

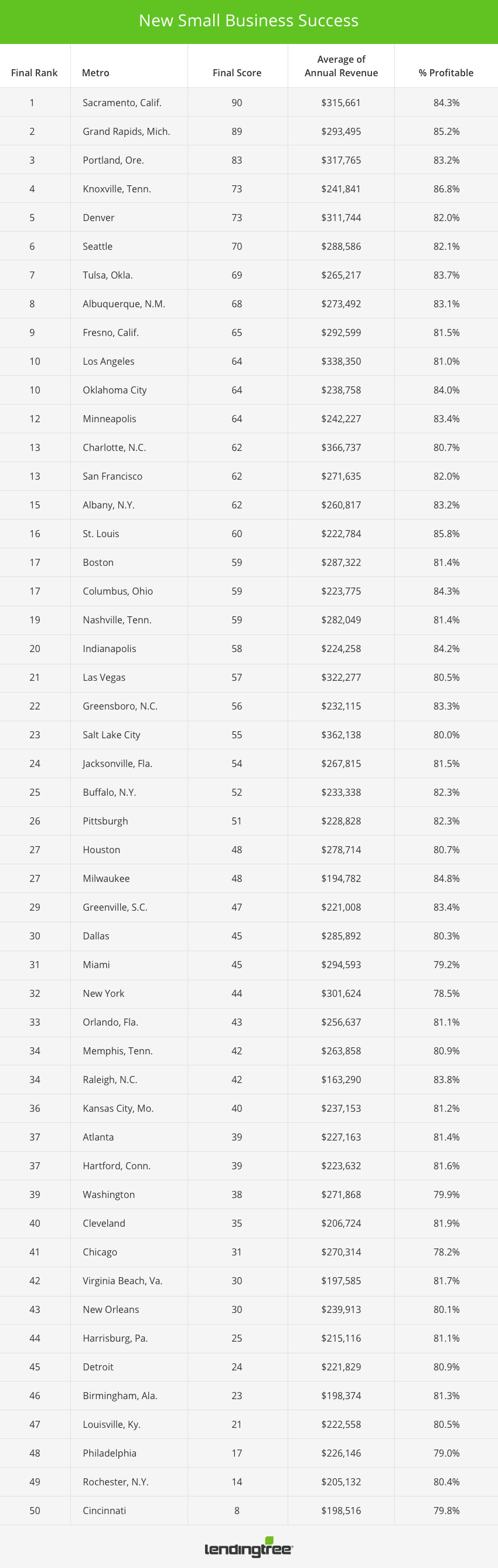

In a new study, LendingTree used data from more than 80,000 queries submitted by new small business owners seeking loan offers through our small business loan marketplace to determine where businesses tend to do the best.

Annual revenue was the first factor LendingTree researchers considered when ranking cities, as all businesses strive to bring in as much revenue as possible. It’s important to note here that gross revenue doesn’t always correlate directly to profitability, as expenses can vary based on an array of influences, including business type and geography. Therefore, LendingTree analyzed the percentage of businesses that reported they were profitable at the time of their queries. By combining these two data series, they were able to draw a picture of how small start-ups are performing, relative to their peers in other places.

Businesses included in the analysis met the following requirements:

- Earn an annual revenue of less than $7,500,000

- Have been in business for at least six months and no longer than 60 months

- Submitted a loan query to LendingTree between Jan. 1, 2016 and Jan. 23, 2018

Applicants self-reported their business’s annual revenue, whether or not the business was profitable at the time they applied for the loan, the date the business was founded and the zip code of the business.

The study was limited to businesses that submitted query forms between six and 60 months after the business was founded, as researchers considered six months a reasonable amount of time to predict annual revenue, and businesses older than five year could be considered established rather than new.

The self-reported data was then limited to the 50 most populous metropolitan statistical areas, as defined by the U.S. Census Bureau. Then, the two factors were scaled to 100, added and divided by two, for the highest possible score of 100 and a lowest possible score of zero. The highest actual score was 90; the lowest score was eight.

Here are some of our key findings:

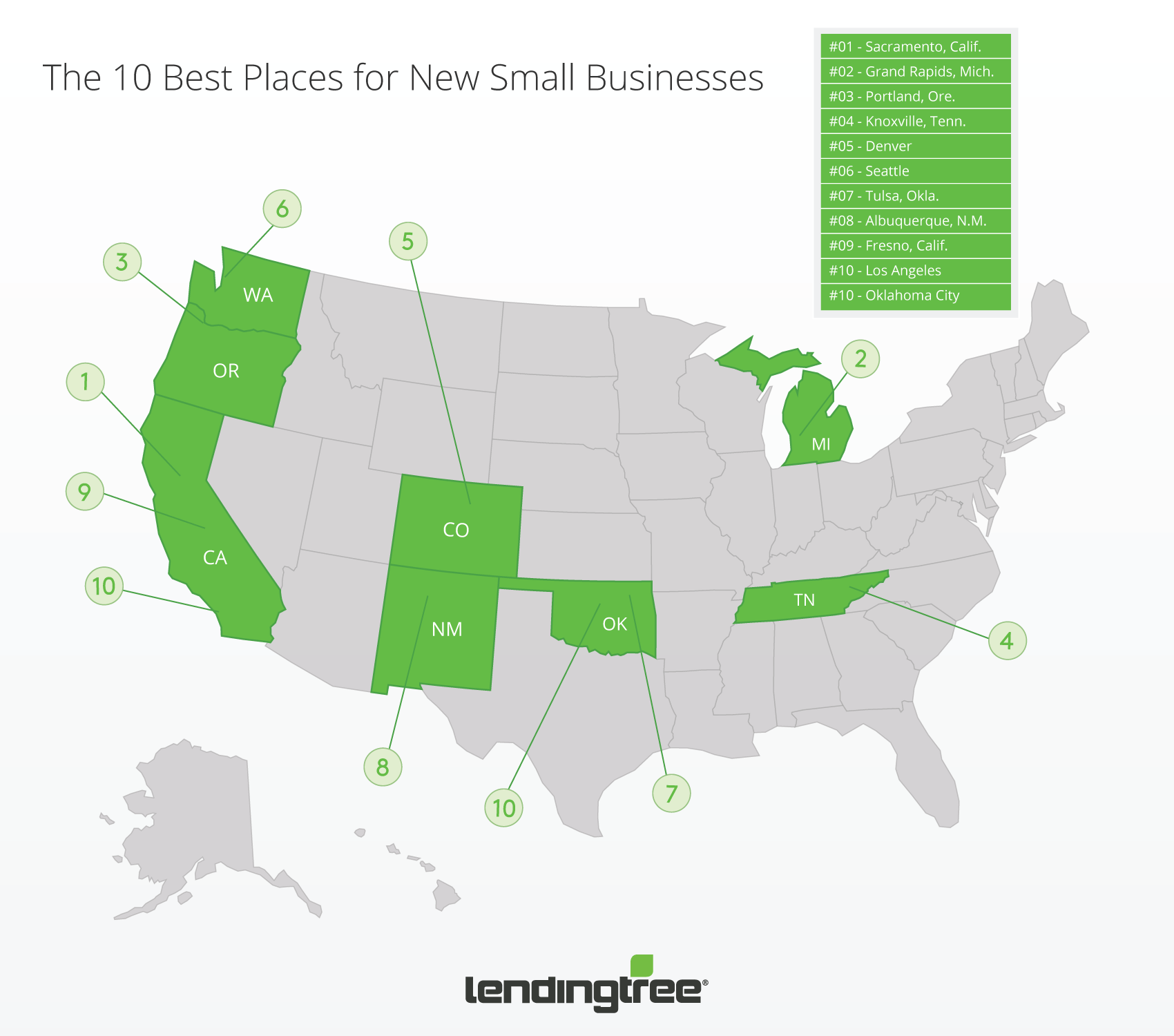

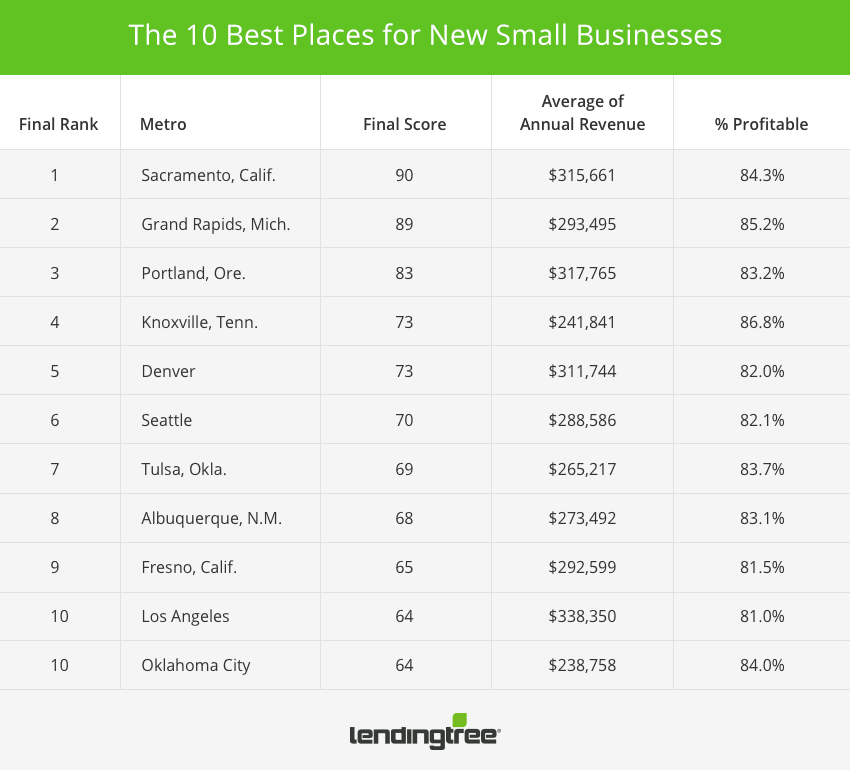

California — 3 cities in the top 10

Three California cities — Sacramento, Los Angeles and Fresno — ranked among the top 10 best places for new small businesses.

Start-ups thrive best in Sacramento, where the average annual revenue of businesses was $315,661, and 84.3% of rising small businesses were profitable.

In Fresno (9) and Los Angeles (tied for 10), businesses averaged $292,599, and $338,350 in annual revenue, respectively. However, Los Angeles lags behind Fresno by half a percentage point, with 81% of applicants reporting their small business was profitable.

Second: Grand Rapids, Mich.

Coming in second place overall was Grand Rapids, Mich. Businesses reported an average annual revenue of $293,495 and 85.2% of applicants were profitable. Businesses in Grand Rapids reported they were profitable more often than businesses in top-ranked Sacramento.

Third: Portland, Ore.

The opposite happened with Portland, Ore. Rounding out the top three, the city reported an average $317,765 in business revenues and 83.2% of businesses reported they were profitable. While Portland’s revenue was higher than top-ranked Sacramento, fewer businesses reported they were profitable, dropping its final score to 83.

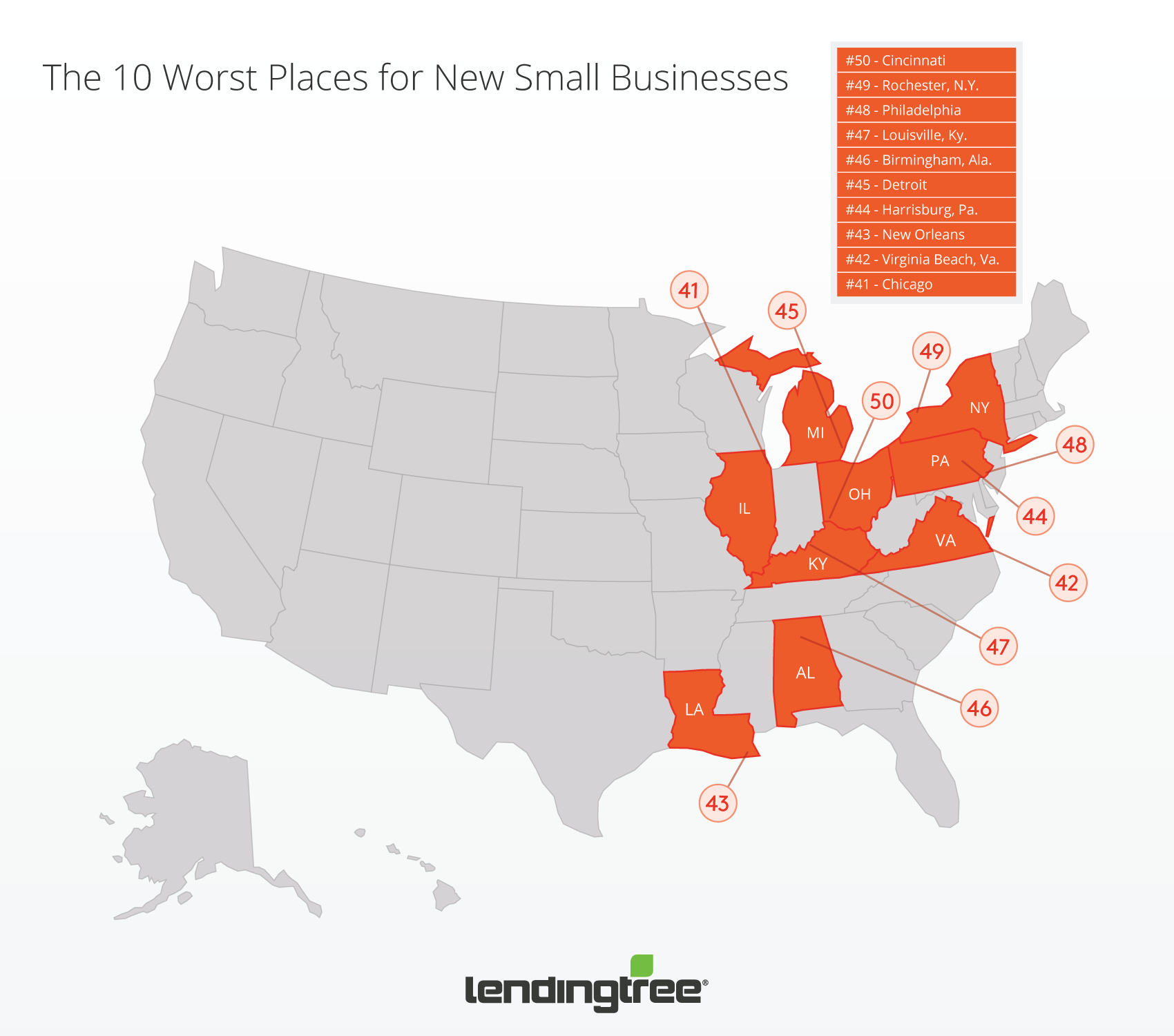

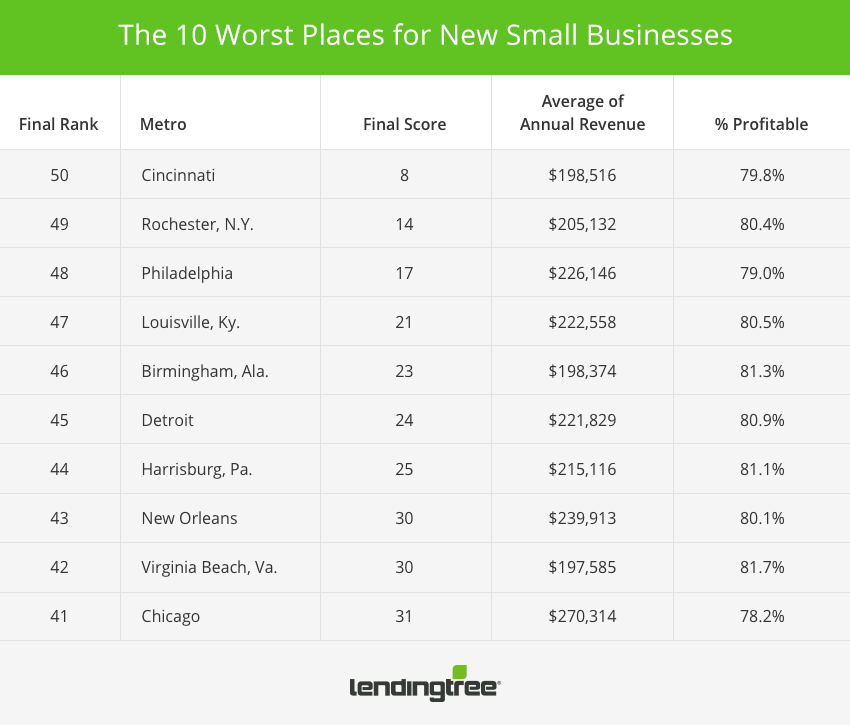

The worst cities for new small businesses

Young companies in Cincinnati reported an average annual revenue of $198,516 and about 79.8% of businesses reported they were profitable.

The city netted itself a low score of eight, the lowest of any other city. Rochester, N.Y., and Philadelphia follow with final scores of 14 and 17, respectively. See the bottom 10 results below, followed by the entire overall rankings.

LendingTree’s top tips for new small businesses seeking funding:

Establish good business credit

When you apply for a business loan, lenders will pull your business credit score to check your eligibility for loans. The lender may or may not check your personal credit score, as many creditors are moving away from relying on personal credit to judge a business’s financial health.

Like your personal credit score, your business credit score can be a determining factor in your financing approval. Your score may also set the tone for the kind of rates and terms you are offered. Businesses with lower credit scores are generally offered less favorable borrowing terms, while businesses with higher scores are more likely to be offered more favorable terms.

Check your business credit report before you apply for financing. Businesses can order a credit report from each of the major credit reporting agencies (Dun & Bradstreet, Equifax and Experian) through their websites.

Not all business credit reports are free. While Dun & Bradstreet charges no fee for its business credit report, Equifax charges $99.99 and a small business credit report through Experian runs $39.95.

When you receive your report, you may find you don’t yet have a business credit score or that your business credit needs some work. Experian gives the following suggestions for building business credit:

- Incorporate or form an LLC (Limited Liability Company) to ensure your company is seen as a separate business entity

- Obtain a federal Employer Identification Number

- Open business bank accounts in your legal business name

- Set up a dedicated business phone line in your business name and make sure it’s listed

Get organized

When you’re seeking funding, you will need to submit important tax and business documents to the lender that will illustrate your financial picture. It’s important you have these documents available and organized to facilitate the process.

Below are a few documents the U.S. Small Business Administration recommends you have to put together a solid loan proposal.

- Business plan, including projections

- Recent bank statements (both business and personal)

- Recent tax returns (both business and personal)

- Profit and loss statements

- Balance sheet

- Income statement

- Proof of collateral

- Proof of equity investment

- Business licenses and registrations

- Leases

- Franchise paperwork (if applicable)

- Existing purchase agreements and contracts with third parties

- Articles of incorporation or partnership

If you need assistance with the paperwork, you may consider reaching out to your local Small Business Development Center or SCORE, comprised of a network of volunteer business mentors, to get in touch with a counselor who can help you put together your proposal.

Know what kind of loan you’re looking for

You may realize you have many options to finance your business when you go looking for lending. There are several types of small business loans you can choose from based on your business goals.

For example, you may choose a working capital loan if you simply want to cover your business’s day-to-day expenses — like payroll— during a slow period. On the other hand, if your business has a high accounts receivable and you will need to pull funds regularly from a rotating line of credit to cover the money that hasn’t come in yet, you may instead opt for a business line of credit.

Demonstrate cash flow

Lenders may ask to see a cash flow statement or to otherwise demonstrate your cash flow to verify the business regularly has enough cash on hand to cover the required debt payments. Your cash flow shows the total amount of money going into and out of the business.

Do a cash flow analysis to see what your business can afford. Document your business’s cash inflow and outflow for a set period. Focus on operations, investing and financing activities. Then, subtract the total outflow from the total inflow and compare it with the balance at the start of that period.

You want the number you end up with to be positive. A positive cash flow means you may have excess funds to cover the debt payment. If you have negative cash flow, a lender may see that and determine the business cannot afford the loan.

Compare lenders

You should always comparison shop when looking for financing. When you’re looking for a business loan, you will have many lenders to choose from. Every bank is different and each application may result in different terms and new pros and cons.

It’s important to compare as many options as reasonably possible before you make a final decision to accept business financing.

Visit LendingTree’s small business loan marketplace to start.

Seek alternative funding

If you’re unable to secure financing with a traditional bank, you may want to consider alternative lending options. Alternative lenders are simply business lending options available outside traditional banks.

Alternative lenders are the most likely to extend credit to small businesses, according to the Harvard Business School. That’s in part because they may use alternative data sets to determine your eligibility. Alternative lenders may not rely as heavily on your business credit score. Instead, they may more heavily consider your business’s cash flow and other noncredit factors to determine the business credit worthiness.